Blockchains for Payments & Stablecoins

Stablecoins and tokenized assets are the latest evolution of payments in finance. Volume has risen rapidly over the past two years, exceeding $27 trillion per year. According to McKinsey, that rate of growth in stablecoin transactions could exceed legacy payment volumes in less than a decade. They offer faster settlement, instant and near-zero-cost transactions across the world with performance that trumps any financial market today.

A new trend is emerging. Smart financial institutions are choosing to power their new stablecoin and payment networks on owned blockchain infrastructure, instead of relying on third-party issuers or services. Thus, they unlock new savings and revenue opportunities.

Interested in building a blockchain solution?

Talk to our team of experts today to get started.

Driving Revenue without Counterparty Risk

Like existing financial systems that rely on third parties for capital transfers and systems management, legacy stablecoin models depend on multiple intermediaries, issuers, or third-party blockchain networks. Each additional third party adds a layer of operational and compliance risk.

In addition, the underlying systems architecture is evolving. Forward-looking institutions are exploring blockchains purpose-built for stablecoin operations. This approach allows organizations to:

- Maintain end-to-end control of issuance and settlement.

- Capture 100% of network transaction fees and usage value.

- Create a vertically integrated payments experience, with programmability at the user, network, or payment level (rules for payments encoded directly on the chain, for automated flows).

- Establish and maintain governance, access control, and security rules that meet organizational standards.

- Seamlessly integrate and interoperate with existing financial/banking experiences, including existing payment networks and financial systems.

The result: banks with native stablecoins capture additional revenue while reducing counterparty exposure. This model allows an organization to control the full value chain, from token issuance to transaction settlement, maximizing revenue and defensibility while aligning incentives with growth.

Easier Compliance and Fast and Stable Performance

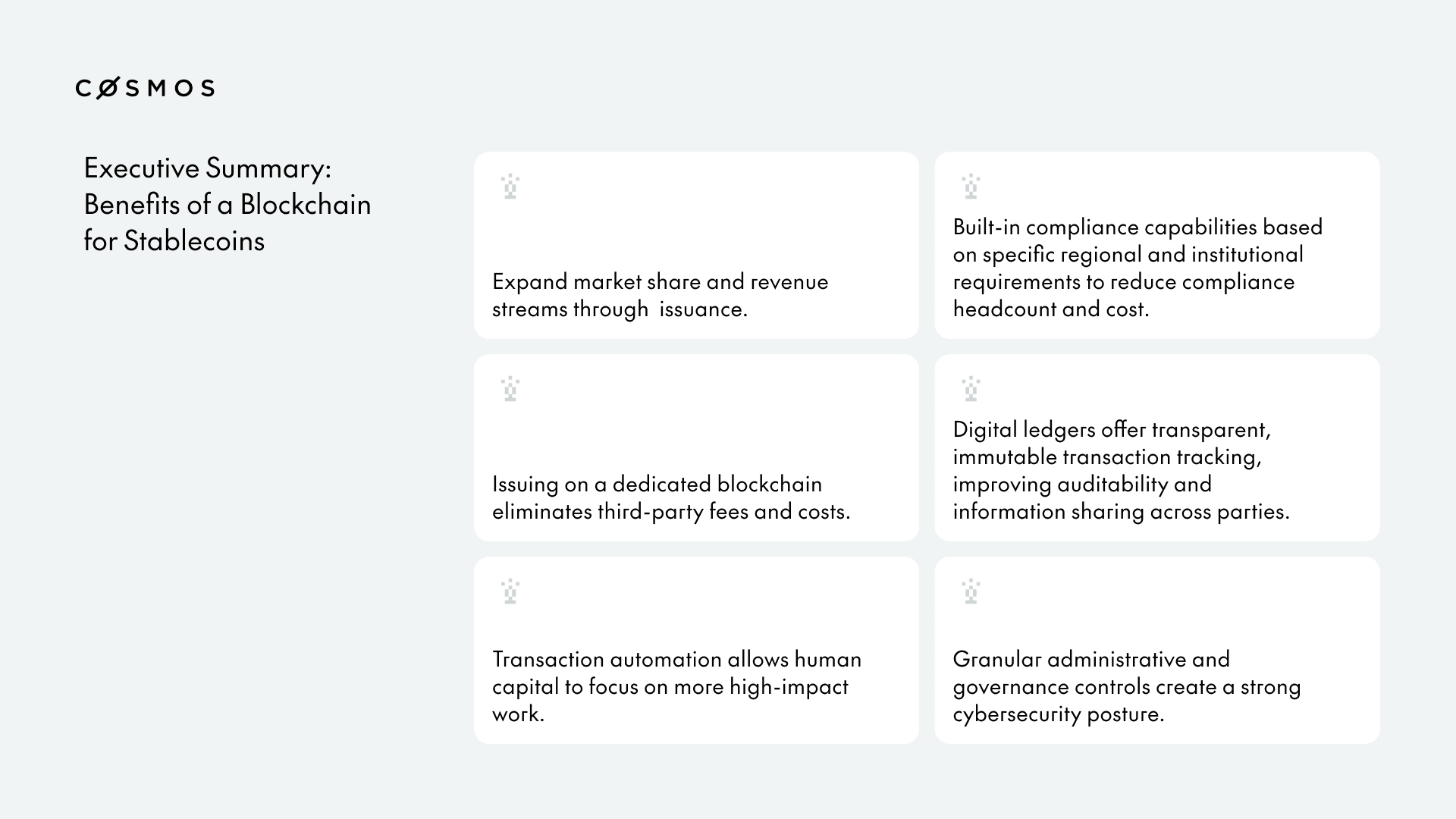

By embedding compliance frameworks directly into the blockchain solution, institutions can create a compliance-optimized infrastructure that achieves high speed and efficiency for both consumer and business use cases. Key benefits of a compliance-first architecture include:

- Built-in compliance capabilities based on specific regional and institutional requirements to reduce compliance headcount and cost.

- Digital ledgers offer transparent, immutable transaction tracking, improving auditability and information sharing across parties.

- Transaction automation allows basic business processes to be automated, allowing human capital to focus on more high-impact work.

- Granular administatrative and governance controls allow for a high level of cybersecurity, access control, and easily verifiable adherence to internal standards.

Performance is equally critical. Networks handling FI and consumer transactions must handle thousands of transactions per second and have a high degree of stability. Blockchain solutions built on the Cosmos blockchain technology stack achieve tens of thousands of transactions per second (TPS) that settle in less than a second. They enjoy stable, battle-tested infrastructure used by 200+ blockchains transferring tens of billions in value annually.

Seamless Interoperability with Existing Systems

Interoperability with existing systems is a requirement for any new solution used by an FI; Cosmos-based blockchain solutions deliver this via a battle-tested technology called the Inter-Blockchain Communication Protocol (IBC). IBC can interoperate with both existing systems and new blockchains for data and asset transfer. Institutions using IBC for interoperability reduce counterparty risk with asset transfers because the tool exists within their technology stack - they no longer need to rely on a third party system for transfers.

Benefits include:

- End-to-end control for payments and asset transfers between entities or customers

- The ability to tailor the user journey for different groups of customers or users

- Reduced counterparty risk

- Increased visibility and management of settlement processes and times

The Cosmos Advantage

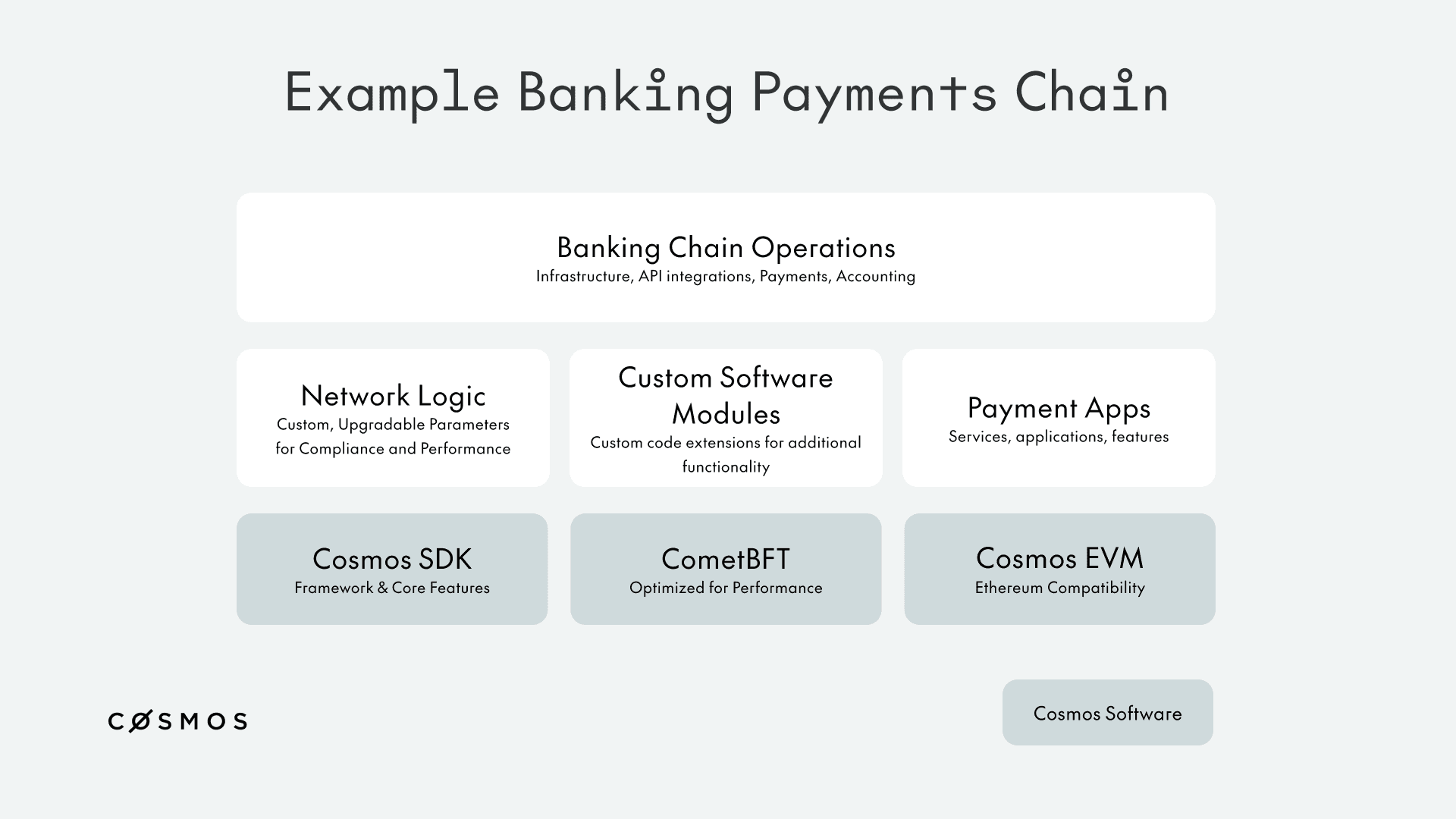

The Cosmos Stack allows you to create an integrated blockchain that powers your stablecoin and payments needs.

Cosmos is the most widely-adopted, battle-tested, and proven blockchain technology stack today. It is a highly secure, modular technology stack optimize to build custom, performant stablecoin and payment networks. Elements include the Cosmos SDK for governance, tokenization, and access control; CometBFT for high-throughput transaction processing and blockchain consensus; Cosmos EVM for full Ethereum compatibility; IBC Protocol for secure cross-chain interoperability; and CosmWasm for secure, high-performance smart contracts.

Enterprises use Cosmos blockchains for use cases like stablecoins, payment networks, asset tokenization, real-world assets, and internal business process automation.

Building the Future Together

Blockchains for payments and stablecoins represent the next phase in blockchain evolution, one that merges institutional-grade trust with open, programmable finance. With Cosmos' technology stack, organizations can build scalable, compliant, and interconnected payment ecosystems.

Talk to an expert to get started.

Talk to an expert.

Sign up for research and updates from the Cosmos Labs team